HiFinance

5

SECTION

2.3.6 - CANCELLED PAYMENTS

USAGE: To undo a payment that has already been entered.

There are several uses for this function. A) a cheque can bounce. B) a receipt

may have been applied to the wrong Creditor.

DISCUSSION: When you start the CANCELLED PAYMENTS program,

the computer will initially ask for a Creditor code. Insert the code and press <Enter>.

To return to the CREDITOR DATA ENTRY MENU, press <ESC>.

To search for a Creditor, press <F9>. For further details on searches, see SECTION 1.2.

Having chosen a Creditor, the screen will display

the name and address and recent balances, in full at the top of the screen. You

will be asked to verify that this is the Creditor you wish and then the screen

will display any unallocated credit transactions.

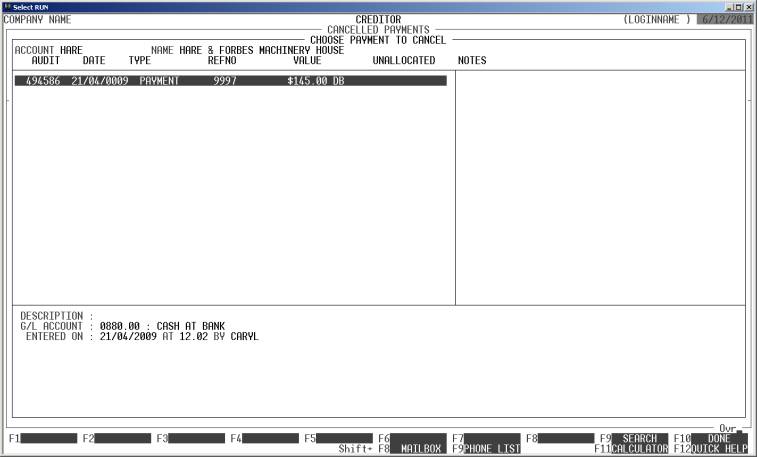

The screen will appear as follows:

The screen displays all the receipt transactions for

the chosen Creditor with the original value of the transaction and the

proportion still unallocated.

You can move around this screen the same way as when

searching for a Creditor (see SECTION 1.1). To choose a transaction, press <F10> or <Enter>. You will then be asked to

confirm your choice. Cancellation is the automatic.

Files updated by the Cancel Payments program:

Creditor

master-file: The value of the payment

will be added back to the outstanding balance of the Creditor.

Creditor

transaction-file: There are several

possible results. HiFinance will create a CANCELLED

RECEIPT transaction for the value of the original transaction. It will pay-off

the original transaction, i.e. the original payment will be fully allocated. If

the original payment was not allocated to anything, both the original and new

transactions will be fully allocated. If the original payment was fully

allocated, the new transaction will be fully unallocated. If the original

transaction was partially allocated, the result will be a mixture of these two

extremes.

General

Ledger master-file: The Trade Creditors,

Cash-at-Bank accounts are updated. If the original transaction included a

discount and/or GST component, these will be unwound in their respective

accounts.

General

Ledger transaction-file: A

transaction is posted for each transaction line.